The CA Quarterly Review (Fall 2022)

THE NEWS QUARTERLY FOR OWNERS AND AGENTS OF THE PERFORMANCE BASED CONTRACT ADMINISTRATION FOR Ohio & washington DC

- From the Desk of DeAnne Foy, General Manager of Contract Administration

-

Welcome to the Autumn 2022 Edition of CA Quarterly Review.

I hope you all were able to relax and recharge over the summer. I am ready for sweater weather, beautiful fall color, and the smell of pumpkin spice.

HUD was busy over the summer, issuing two major publications.In June, HUD published the Management and Occupancy Review (MOR) Rule and Notice. Effective September 26, 2022, the rule moves to a performance-based MOR schedule to establish a risk-based scheduling protocol, reduce the frequency of MORs for projects that consistently perform well, and provide consistency across programs with respect to MOR frequency.

It is very easy for a consistently high performing property to slide when new, inexperienced staff is hired, particularly when turnover is high. As staffing issues continue to be a concern across the country, it is important to remain diligent about training and cross-training employees so as not to create a vacuum if someone leaves. Long-term employees play a key role in helping newcomers succeed. Asking staff for feedback and being open to suggestions can be effective at preventing turnover.

In July, HUD issued the Draft Housing Assistance Payment Support Services (HAPSS) Procurement Solicitation for public comment. I hope you have had an opportunity to read this important publication and perhaps comment. It proposes sweeping changes to the current PBCA structure. AHSC has highly valued its partnership with HUD for twenty-two years. Of course, we would love to continue in our shared mission of providing access to safe and affordable housing for the foreseeable future.

Have a wonderful fall season and thank you for all your hard work.

DeAnne Foy

General Manager of Contract Administration, Ohio and Washington, D.C.

Affirmative Fair Housing Marketing Plan and Guidance from the Office of Fair Housing and Equal Opportunity (FHEO)-

Each multifamily property must develop and carry out an Affirmative Fair Housing Marketing Plan to ensure that they are marketing to those least likely to apply when advertising. The marketing efforts need to attract a cross section of the eligible population without regard to race, color, religion, sex, disability, familial status or national origin. Any marketing efforts for available units must be carried out in accordance with the HUD-approved Affirmative Fair Housing Marketing Plan (AFHMP). Owner/Agents must comply with the requirements outlined in the approved AFHMP to ensure they are promoting equal housing opportunities to all eligible families within similar income levels.

When a property is initially leased up or when available units cannot be filled from the waiting list, then Owners/Agents must advertise to attract eligible applicants. The marketing efforts must:

- Publicize the availability of housing opportunities to all persons regardless of race, color, sex, religion, familial status, disability or national origin;

- Target advertising to groups other than those who typically live in the local population of the property, reaching out to those least likely to apply because they are not in the predominant racial or ethnic group of the neighborhood;

- Include the HUD Equal Housing Opportunity logo, slogan, or statement; and

- Market to those in the Limited English Proficiency population.

Compliance Reviews

During compliance reviews, Owner/Agents must be able to provide documentation that marketing activities follow along with the requirements outlined in their HUD approved AFHMP. Auditors will review the advertising/marketing materials for compliance, records of the marketing activities conducted and that the marketing plan still applies for the property/population. Owners must review the plan every five years or when the local Community Development jurisdictions consolidated Plan is updated. The demographics of the market must be reviewed to determine if there have been any changes in the population in terms of race, ethnicity, religion, persons with disabilities and/or large families. That information needs to be reviewed against the current approved AFHMP to ensure that all advertising efforts listed within the plan still apply. Even if the demographics have not changed, the plan should still be reviewed.

- If after reviewing the plan and updates are needed, the updated plan then needs to be submitted to HUD for review and approval. Documentation that the revised plan was sent to HUD should be made available for the auditor.

- If no updates were needed then documentation should be noted about what was reviewed, who reviewed the document, what was found as a result of the review, and why no change is required. The auditor will review that information during a compliance review.

New Recommendations from HUD’s Office of Fair Housing

The Office of Fair Housing and Equal Opportunity (FHEO) has provided new recommendations on how owner/agents in the housing industry can advertise the availability of housing assistance without employing marketing, application processing, and waitlist management practices that limit access for eligible housing-seekers in the area. Owners and Agents of multifamily housing communities are strongly encouraged to become familiar with the Guidance on Compliance with Title VI of the Civil Rights Act in Marketing and Application Processing at Subsidized Multifamily Housing Properties.

HUD has also provided an Implementation Sheet for HUD’s Title VI Guidance Regarding Marketing and Application Processing at Subsidized Multifamily Housing Properties to assist owners and agents as they evaluate their marketing strategies.

- Family Self Sufficiency Final Rule Published

-

HUD has announced the Final Rule implementing the re-authorization of the Family Self Sufficiency (FSS) program was published in the Federal Register on May 17, 2022. FSS is a voluntary program for multifamily owners and residents that provides incentives and support to help families living in HUD-assisted housing to increase their earnings and build financial assets.

HUD anticipates that these changes will simplify the operation of the Multifamily FSS programs. The new final rule updates regulations under 24 CFR 984 and 24 CFR 877 and creates important changes for FSS programs in Multifamily properties, highlights of which are described below.

There have been some major changes that HUD is highlighting for Operating Programs. Those include, but are not limited to:

- New Reporting Forms and escrow calculation worksheets (listed below under New Forms)

- Reduced burden of reporting – from quarterly reports to annual reports

- New requirements for action plans; most owners will need to submit new action plans to match the new reporting requirements, but we expect most required changes to be small.

- More ability to pool resources with other FSS programs, including those operated by PHAs

In addition, there are three new reporting forms for Multifamily FSS programs, all of which can be found on the HUD Multifamily website under “Asset Management Quick Links”:

- HUD 52650 Contract of Participation – incorporating all of the regulatory changes through the new final rule;

- Multifamily FSS Reporting Tool Instructions 2022; and

- Monthly FSS Escrow Credit Worksheet 2022

Owners are reminded that you must submit your action plan with the action plan checklist. This can be found on the FSS Program Website

Important Dates to keep in mind; the final rule goes into effect on June 17th, and all required changes to programs (e.g., new action plans) must occur before November 14th.

This means that starting on June 17th Multifamily FSS program operators should discontinue submitting quarterly reports and that all changes to action plans must be submitted before November 14th. Note that edited action plan must be approved by HUD before owners can begin using the new forms and that all participants (including existing participants) must sign the new contract of participation. You cannot enroll new participants in your FSS program until your revised action plans are approved.

An updated version of Housing Notice H-2016-08 to incorporate changes to the Multifamily FSS program is currently being drafted, as are updates to the FSS guidebook, including a chapter dedicated to running FSS at PBRA properties.

Notice of Funding Opportunity (NOFO)

The application period for funding under the Family Self-Sufficiency (FSS) Notice of Funding Opportunity (NOFO) is currently open. For the first time, owners of properties participating in Project-Based Rental Assistance can apply for funding under this NOFO. Applications are due on or before October 7, 2022.

To assist owners, this week, HUD posted on the HUD Funds Available Page:

- The FSS NOFO Webinar Presentation - provides a general overview of the NOFO and discusses information related to applying for the grant.

- The FSS NOFO FAQs - Provides important information on questions regarding the submission of your grant application.

For additional resources and guidance on the FSS program, please see the FSS Resource Page.

Reach out to MF_FSS@hud.gov with any urgent questions on reporting

Multifamily FSS program operators are encouraged to join the Family Self-Sufficiency (FSS) Program HUD Mailing List at https://www.hud.gov/subscribe/mailinglist to receive periodic emails with FSS program updates and resources

- Excluding the Use of Arrest Records in Housing Decisions

-

In November 2015, HUD published Notice 2015-10 which discusses the use of arrest records when owners make decisions affecting an applicant’s admission or a tenant’s occupancy of a subsidized unit. For the past five years HUD has been an active member of the Federal Interagency Reentry Council. This Council, made up of more than 23 Federal Agencies, meets on a regular basis to act on issues that affect the lives of those released from incarceration. An important aspect of the Reentry Council's work has been to have each Federal Agency identify and address "collateral consequences" that individuals and their families may face because they or a family member has been incarcerated or has had any involvement with the criminal justice system.

Use of Arrest Records

The purpose of the Notice is to inform owners of other federally-assisted housing that arrest records may not be the basis for denying admission, terminating assistance or evicting tenants, to remind owners that HUD does not require their adoption of "One Strike" policies, and to remind them of their obligation to safeguard the due process rights of applicants and tenants. The Notice also reminds owners of their obligation to ensure that any admissions and occupancy requirements they impose comply with applicable civil rights requirements contained in the Fair Housing Act, Title VI of the Civil Rights Act of 1964, Section 504 of the Rehabilitation Act, and Titles II and III of the Americans with Disabilities Act of 1990, and the other equal opportunity provisions listed in 24 CFR 5.105. Finally, the Notice provides best practices and peer examples for PHAs and owners to review.

Owner Discretion

HUD does not require that owners adopt or enforce so-called "one-strike" rules that deny admission to anyone with a criminal record or that require automatic eviction any time a household member engages in criminal activity in violation of their lease. Instead, in most cases, owners have discretion to decide whether or not to deny admission to an applicant with certain types of criminal history, or terminate assistance or evict a household if a tenant, household member, or guest engages in certain drug-related or certain other criminal activity on or off the premises (in the case of public housing) or on or near the premises (in the case of Section 8 programs).In deciding whether to exercise their discretion to admit or retain an individual or household that has engaged in criminal activity, owners may consider all of the circumstances relevant to the particular admission or eviction decision, including but not limited to: the seriousness of the offending action; the effect that eviction of the entire household would have on family members not involved in the criminal activity; and the extent to which the leaseholder has taken all reasonable steps to prevent or mitigate the criminal activity. Additionally, when specifically considering whether to deny admission or terminate assistance or tenancy for illegal drug use by a household member who is no longer engaged in such activity, an owner may consider whether the household member is participating in or has successfully completed a drug rehabilitation program, or has otherwise been rehabilitated successfully.

Subject to limitations imposed by the Fair Housing Act and other civil rights requirements, owners generally retain broad discretion in setting admission, termination of assistance, and eviction policies for their programs and properties. Even so, such policies must ensure that adverse housing decisions based upon criminal activity are supported by sufficient evidence that the individual engaged in such activity. Specifically, before an owner denies admission to, terminates the assistance of, or evicts an individual or household on the basis of criminal activity by a household member or guest, the PHA or owner must determine that the relevant individual engaged in such activity. HUD has reviewed relevant case law and determined that the fact that an individual was arrested is not evidence that he or she has engaged in criminal activity. Accordingly, the fact that there has been an arrest for a crime is not a basis for the requisite determination that the relevant individual engaged in criminal activity warranting denial of admission, termination of assistance, or eviction.

Implications

An arrest shows nothing more than that someone probably suspected the person apprehended of an offense. In many cases, arrests do not result in criminal charges, and even where they do, such charges can be and often are dismissed or the person is not convicted of the crime alleged. In fact, in the 75 largest counties in the country, approximately one-third of felony arrests did not result in conviction, with about one-quarter of all cases ending in dismissal. Moreover, arrest records are often inaccurate or incomplete (e.g., by failing to indicate whether the individual was prosecuted, convicted, or acquitted), such that reliance on arrests not resulting in conviction as the basis for denying applicants or terminating the assistance or tenancy of a household or household member may result in unwarranted denials of admission to or eviction from federally subsidized housing.

Although a record of arrest(s) may not be used to deny a housing opportunity, owners may make an adverse housing decision based on the conduct underlying an arrest if the conduct indicates that the individual is not suitable for tenancy and the owner has sufficient evidence other than the fact of arrest that the individual engaged in the conduct. The conduct, not the arrest, is what is relevant for admissions and tenancy decisions. An arrest record can trigger an inquiry into whether there is sufficient evidence for an owner to determine that a person engaged in disqualifying criminal activity, but is not itself evidence on which to base a determination. Owners can utilize other evidence, such as police reports detailing the circumstances of the arrest, witness statements, and other relevant documentation to assist them in making a determination that disqualifying conduct occurred. Reliable evidence of a conviction for criminal conduct that would disqualify an individual for tenancy may also be the basis for determining that the disqualifying conduct in fact occurred.

Owners are encouraged to adopt continuing occupancy policies based on the best practices highlighted to guard against unwarranted denial of assistance, termination from program participation, or eviction from federally assisted housing. Owners are also encouraged to read the Shriver Report entitled "When Discretion Means Denial: A National Perspective on Criminal Records Barriers to Federally Subsidized Housing."

- Community Solar Credits Memo

-

Multifamily Housing has received several requests from state and local governments about how they interpret community solar credits and when these credits can be excluded from income and utility allowance calculations. The MF Community Solar Credits Memo reflects how they have approached these requests to date and may be helpful to state and local government and owners as they consider also these issues.

The notice provides guidance to HUD Multifamily Housing (MFH) field staff, owners, and management agents on the treatment of on-bill virtual net energy metering credits that commonly result from a resident’s participation in a community solar program. This only applies in the case of tenant-paid electricity and where the solar credit appears as a negative amount on the electricity bill. The guidance does not apply to residents of master-metered multifamily buildings. In addition, the guidance does not change existing rules for utility allowance baseline analyses requirements or income calculations; rather, it provides guidance for how to treat community solar credits within existing rules.

Determination of Treatment of Solar Credits in Utility Allowance and Annual Income Calculation

The following two-step process may be used to determine whether the community solar credits should be included/excluded from the utility allowance baseline analysis or included/excluded from a family’s annual income for purposes of rent calculation and/or eligibility determination.

Step One: Determine if Community Solar Credits Affect Utility Allowance Calculation

Step One is a test for determining the community solar credit’s relationship to the utility allowance calculation. To understand the effect of a community solar credit on a unit’s utility allowance calculation, you will need a copy of the tenant’s electricity bill (this can be accessed by the utility company if it is not already available). Per this guidance, you will not need any additional information as the solar credit will appear as a negative amount on the tenant’s electricity bill.

If the credit reduces the cost of energy consumption by lowering actual utility rates, then the owner is required to submit a new baseline analysis in accordance with Housing Notice 2015-04, regardless of when the last analysis was submitted to HUD/Contract Administrator for approval.

Factors for determining whether the credit is tied to the cost of consumption:

- Is the credit a third-party payment (e.g., not from the electricity provider) on behalf of the tenant rather than a reduction in the cost of utilities?

a. Yes -Credit is not considered to reduce the cost of energy consumption as the cost for the utility provider to provide the consumed energy does not change. The owner is not required to submit a new utility allowance baseline analysis

b. No -Credit may be tied to the cost of consumption. Proceed to question #2 below.

2. Does the credit amount fluctuate every month and/or does the electric bill show a lowered utility rate per kilowatt-hour?

a. Yes - Credit is tied to the cost of utility consumption. The owner is required to submit a new utility allowance baseline analysis.

b. No - Credit is not tied to the cost of utility consumption. The owner is not required to submit a new utility allowance baseline analysis.

Example bills with solar credits not tied to consumption can be found in the Appendix of the memo.

Step Two: Determine if Community Solar Credits Should be Considered Annual Income for Rent Calculation or Determining Eligibility for HUD-assisted Multifamily Programs

The second step is to determine if the credits fall within HUD’s definition of annual income. In all foreseeable instances as of the date of the memo, if the solar credit is tied to the cost of consumption (i.e., utility allowance is affected) (addressed in Step One), then credit will not count towards income.

If a community solar benefit appears on a household’s electricity bill as an amount credited from the total cost of the bill, HUD has determined that the credit should be treated as a discount or coupon to achieve a lower energy bill (rather than a cash payment or cash-equivalent payment being made available to a resident). In this case, the credit will not be counted towards income as discounts on items purchased by a tenant are not viewed as “annual income” to the family. Generally, income is not generated when a family purchases something at a cheaper rate than it otherwise would.

Note that if the credits are found to be third-party payments based on Step One, there may be instances when the credits are not mere discounts and must be treated as income. For instance, a recurring monthly utility payment made on behalf of the family by an individual outside of the household is not considered a discount but is considered annual income to the family.

For more information, you are encouraged to read the MF Community Solar Credits Memo in it’s entirety.

- Proactive Pest Control

-

As the leaves start changing and the temperature starts dropping, it’s that time of year when pests, particularly rodents, start gravitating towards the indoors. Although pests can be a problem year round in most places, some specifically move indoors in the Fall and Winter months to stay warm. It would be good practice, if not already done on a regular basis, to perform monthly pest/housekeeping inspections.

Most properties, such as elderly/disabled buildings, usually engage in monthly or quarterly preventative treatments and pest/housekeeping inspections. One of the main reasons for this is that all residents are not always forthcoming on reporting pest issues for a variety of reasons, such as worried about cost, lease violations, etc. This is a good practice to help identify residents with housekeeping issues that may be lending to the pest problem in the building. This leads to the next issue, hoarding.

The PBCA Call Center receives numerous hoarding problems in all states served which are contributing to massive pest issues on the properties and not enough is being done, in some cases, to address these issues. Hoarding things, regardless of what it may be, is also a huge fire hazard and potential liability for management. It also affects the ability for exterminators to properly treat a unit for mice, roaches, bed bugs, etc. Hoarding provides a perfect environment for pests. After a certain point, an exterminator will refuse to even treat an apartment if the housekeeping issues are not addressed by the tenant. So be sure to be proactive and inspect those units!

- Vouchering Tips: Unique Entity Identifier (UEI) and FAQ Update – HUD Notice H 2015-04

-

Earlier this year, HUD announced that the federal government will transition away from using the Dun & Bradstreet data universal numbering system (DUNS) to the new Unique Entity Identifier (UEI) for identification for federal awards. The FAQ to the Housing Utility Allowance Notice H 2015-04 was also revised to provide clarification on Utility Allowance Reimbursements. How both changes impact vouchering are explained below.

Unique Entity IdentifierAs of April 4, 2022, the federal government stopped using the Dun & Bradstreet data universal numbering system (DUNS) number to uniquely identify entities. Now, entities doing business with the federal government will use the Unique Entity ID (UEI) created in the Sam.gov website. This change poses an issue with the electronic voucher and electronic tenant files. Since the DUNS Number is a 9-character numeric value and the new UEI is a 12-character alphanumeric value, the new UEI cannot just replace the DUNS number on electronic files.

Per the TRACS UEI Notification, TRACS Release 203A will include an upgrade to accommodate the new UEI to the end of the Voucher and Tenant MAT header records. Until then, Owner/Agents should continue to use the same DUNS number even if a UEI has been assigned. This will prevent the voucher and/or tenant files from being rejected by TRACS since the UEI cannot be used. For all new Owner entities who do not have an assigned DUNS number but only an assigned UEI, Owner/Agents will use “123456789” in the Owner DUNS Number field. TRACS UEI Notification also confirms that, “A TRACS error message for missing DUNS number is for informational purposes and does not suspend or stop electronic request for subsidy payment.”

Please note: Initial guidance noted in the TRACS UEI Notification was to leave the DUNS number field blank. However, TRACS has confirmed that the DUNS number must be filled with “123456789” until 203A implementation.

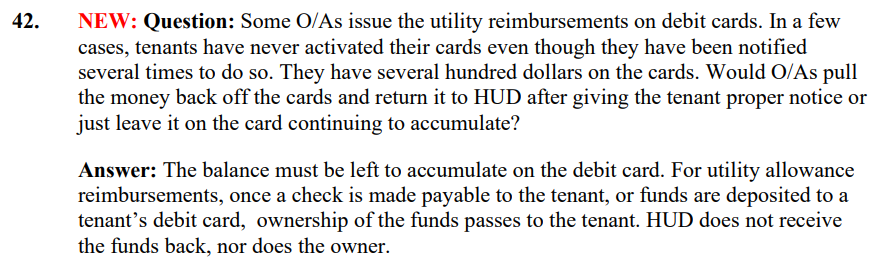

FAQ Update: Housing Notice H 2015-04HUD published a revision to the HUD Housing Notice H 2015-04 FAQ which added the following question and answer:

Based on this answer, Owner/Agents will no longer be required to enter a UUTL (Unclaimed Utility Check) miscellaneous adjustment entry to return funds back to HUD for any unclaimed utility allowance funds on the voucher.

- Upcoming Email Changes for AHSC

-

AHSC is migrating to a new email platform, so you can expect to see some changes to the emails being sent by the PBCA. More information will be forthcoming as we transition.

All PBCA emails will soon have a @housing.systems address instead of @cgifederal.com address.

- Member Spotlight

Hi, I am Suzanne Flannery I am a Local Contract Specialist for Assisted Housing Services Corporation and I have been with the company for just over 6 years. My job is to conduct Management and Occupancy Reviews (MOR) for owners of subsidized properties in the southern and surrounding regions of Ohio. I am responsible for writing detailed reports involving findings of non-compliance while referencing HUD criteria and listing corrective actions needed to restore compliance. Some areas of project compliance include Leasing and Occupancy, Rent Calculations, EIV Policies and Procedures, and a review of the Tenant Selection Plan. My job also includes establishing and maintaining effective communication with the owners to ensure adequate and timely responses needed to close the MOR Report.

Previously my career began in the hospitality industry. I started out as the Banquets and Catering Manager for a fine dining restaurant called the Nellie Peck, which was located inside of the Ramada Inn in downtown Portsmouth. I was about 21 at the time so it came with its challenges as a young manager, but I excelled at it and loved it at the same time. Shortly after proving myself I became Manager of the hotel, which I loved as well. I ran the hotel as if it was my own. I scheduled myself two days a week on the front desk and I trained my own staff. This gave me the opportunity to know all repeat guests as well as what knowledge my staff had and how they were performing. I guess you could say I had a mid-life crisis in some sense because I started thinking about retirement, which I did not have in my 30’s as manager of the hotel so I began looking for employment that offered that even though I LOVED my position at the hotel.

I then was offered a position at the local housing authority and through my 14 years with them I wore many hats. I started off as an Area Housing Manager I and moved on to Section 8 Local Contract Specialist, Finance Assistant II and lastly Section 8 Coordinator. I learned a lot to say the least. I can say that my most favorable position of those was the family property I managed that had 243 units. There was never down time and it was always eventful, which I thrive on.

As far as my employment with CGI I enjoy helping Owner/Agents in their day to day tasks by effectively sharing ideas and suggestions on ways to improve their best practices on their next MOR. A lot of the MOR’s that I conduct are with the same property or Owner/Agent and seeing them improve each year makes me happy and that’s when I know I’ve done my job.I always tell each Owner/Agent when I go in to conduct an MOR that each MOR is a learning session. It is your chance to ask me any questions or concerns that you may have and we will go over them. We are not there to criticize or make anyone uncomfortable. Our job is to always help you and make your next MOR better than the last.

In my down time I love to travel! My goal is to see every state at least once. I also enjoy wine tastings, reading and spending time with my new puppy Winston.From Marnie Hess, Suzanne’s Supervisor:

Suzanne has been an integral part of our team over the last six years. She is a wealth of knowledge and is always kind and considerate of others. Her team members respect and appreciate her because she is active in collaborating with her peers and managers. Suzanne is often spoken of highly of by her Owners and Agents due to her ability to build good relationships. She ensures that each Owner/Agent has her full attention during an MOR and is always willing to go the extra mile to assist them in learning the Section 8 program. Suzanne’s good nature and kind heart is observed by all who come in contact with her. We can always count on her to smile and spread her laughter throughout the office!

- AHSC Contact Center Poster

-

Assisted Housing Services Corporation (AHSC) has created a Customer Contact Center poster that our Owners and Agents of Section 8 Multifamily Housing can post in their rental office. This poster will provide your residents with useful information, such as our business hours, contact information, and general issues that AHSC can assist with, including but not limited to:

- Answering questions about the calculation of a tenant’s rent

- Assisting with clarifying HUD Occupancy Handbook 4350.3 requirements

- Serving as a neutral third party to residents, property owners and management agents, and the general public

A downloadable version of the AHSC Contact Center Poster can be found on the AHSC Website following the links be-low. Or you can find a copy from the Owner/Agent Knowledge Center on the AHSC Website, under the Management and Occupancy tab.

If you are not already receiving this publication via e-mail, or if you have ideas, suggestions, or questions for future publications, we’d like to hear from you. Please send an email to heather.blankenship@cgifederal.com